Anchiano Therapeutics files for $30-40m Nasdaq offering

Shavit Capital, founded by managing partner Gary Leibler, which usually invests in companies before their IPOs, invested in both Gamida Cell and Anchiano (it owns 13% of Anchiano). Leibler is probably one of the parties pushing for an early IPO before the current window of opportunity for medical companies on Nasdaq closes (it has been open for 18 months, a fairly long period).

Anchiano has developed a cancer drug containing a diphtheria toxin and a medicinal component capable of homing in on H19, a specific receptor in the body that almost never appears in healthy cells. The company’s lead product, which is designed to treat bladder cancer, is about to undergo two Phase III trials that should lead to approval of the product.

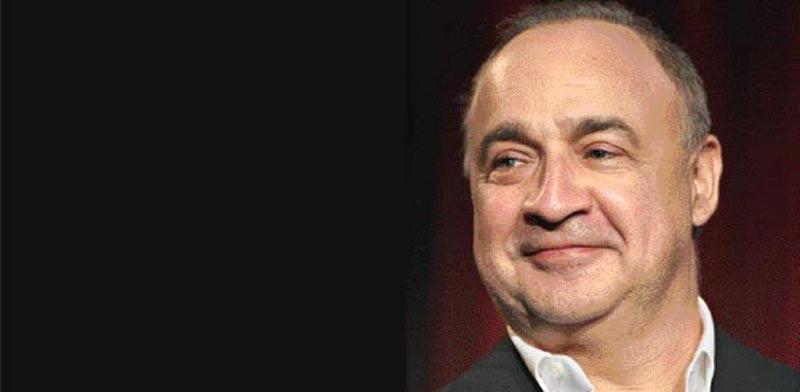

The name Anchiano, Leonardo da Vinci’s hometown, is designed to make people forget BioCancell, which was very promising but did not always live up to its billing. The company had trouble deciding what form of the drug to develop. One of its clinical trials was not very successful, the company underwent a cash crisis, and was little traded on the TASE because Clal Biotechnology held so large a stake in it. With Shavit’s investment and Clal Biotechnology’s offer for sale in late 2017, and following the appointment of president and CEO Frank Haluska, the company received a new lease on life.

Published by Globes, Israel business news – en.globes.co.il – on November 1, 2018

© Copyright of Globes Publisher Itonut (1983) Ltd. 2018